This is often a question founders find hard to answer early on in their journey. Many founders look at their competitors and they simply pick a price in-line with them in an attempt to be competitive.

There are a lot of factors to consider when selecting your price, such as whether you have a high-margin / low-volume product or a low-margin / high-volume product. While thoughtbot can help with this kind of strategy decision, we won’t be able to do that on an individual basis in this blog (get in touch with us if you would like to go over this; we’d be happy to help!). We can however give you some general tips to find a good price point, at least to get you started.

There are two approaches and they are both based on unit economics and simple algebra:

- Start with your costs

- Start with a strategic price

Before delving into each, we should familiarise ourselves with the concept of unit economics. Unit economics is essentially the cost to produce and sell a single unit of your product and how much revenue selling one unit will generate. Your costs should incorporate everything like the cost of raw materials, marketing & ad spend, rainy day savings fund, etc. By analysing unit economics, a company can determine whether its business model is financially viable and profitable on a per-unit basis and at scale.

The basic Algebraic formula we will use is:

(Total costs) + (desired margin) = Your price.

Method 1 - Start with your costs:

The first approach is to start with your costs. We recently followed this exact strategy when working with Legacy Forest. This helped them to close a deal worth roughly €500,000 per year with a state body (case study coming soon!).

When using the cost first method, the first step you need to take is to clearly define your costs for producing your product. Let’s imagine that you have founded a new reusable water bottle company called “Wattle”. If you sell online Direct to Consumer, Wattlel’s costs might include:

- Materials for the bottle - $5**

- Manufacturing one bottle - $4.50

- Packaging - $1.50***

- Transaction fee/payment processing fee (Stripe or equivalent) - $0.40

- Shipping fee - $3

- Marketing & ad spend (customer acquisition cost) - $4

- Rainy day reserves - $1.50

- Tos

** Total manufacturing costs will be a large number as the bottles will be produced in bulk but we divide this cost by the number of units produced to get our unit economic cost.

*** Like manufacturing, packaging might be purchased in bulk and then divided by the number of units it can provide for.

Note that we can leave out capital investment costs like moulding or tooling from our unit economics unless a loan has been taken out to build those. In that case a repayment per bottle could be added.

Also note that if you are unsure how much money you will need for the likes of your customer acquisition cost, try to find the financials of competitor companies. You don’t have to use the exact same figure but you could spend proportionally similar. For example, if a major rival in your space is generating $100 million per year and they spend $10 million per year on customer acquisition, you might consider marketing and ad spend making up 10-20% of your costs (as a bigger name your competitor already has brand recognition so may not need to spend as much as you in this area but you could be in the same ballpark proportionally).

This gives us a total cost per bottle of $19.90.

Our equation now looks like this:

($19.90) + (desired margin) = Your price.

Next up we will pick our margin. As specified, margins in certain product categories might typically be lower (in a high-volume market) or higher in an industry like technology. Continuing with our Wattle water bottle example, we could look at competitors in the water bottle industry to give us a guide as to the margins we will need to operate on. In the absence of more industry insights, 50% is usually a decent margin to get the ball rolling. This means we will have the same amount of profit margin as our costs. Our equation can now be completed.

($19.90) + ($19.90) = $39.80.

Our price point to sell these water bottles profitably is $39.80. Realistically we would increase this slightly to $39.99 to make the price more familiar to customers.

It is worth noting that for most consumer products some form of sales tax will need to be applied. In places like the US, this is generally added after the display price. In Europe and other countries, the sales tax must be included in the price. This can have an impact on your margins so watch out for tax.

Method 2 - Start with a strategic price:

In some industries where customers are extremely price sensitive you may not be at liberty to pick a price based on your costs. In such cases, we can use the inverse to the cost + margin pricing approach outlined in Method 1. This second method comes from “Blue Ocean Strategy” (a great book for all you founders out there looking to differentiate your product).

To compete in a very price sensitive market, a company can start with a ‘strategic price’ and then deduct its desired profit margin from the price to arrive at the ‘target cost’. This approach can result in a price point that is both profitable and hard for competitors to match.

One thing to note here is that to achieve a strategic price, costs often need to be aggressively driven down. To do this your company needs to be very focused on your USP to achieve divergence from competitors.

Let’s take a look at our fictitious water bottle company “Watte” again. Suppose that after doing some market research we realise that our proposed price of $39.99 from Method 1 is too high and that virtually every water bottle in our market is sold for between $25 and $35. We’re going to need to cut our prices and have decided that $29.99 is the price we would like to sell at. Our formula now looks like this:

(Total costs) + (desired margin) = $29.99.

We want to maintain our 50% margin to remain profitable. Therefore, we will be dividing our strategic price by 2:

($14.99) + ($14.99) = $29.99.

Because we started with our strategic price and worked backwards, we now know that our ‘target cost’ is $14.99 (let’s call it $15). From here we can address our unit economics to try to make them fit into this cost structure.

As previously mentioned, this type of pricing might be difficult to do without some aggressive cost cutting measures. We need to accept the fact that our Wattle water bottles will not be able to be the best water bottle on the market in every category at this competitive price point. To find out where to make cuts, we first need to analyse competitors in our industry to see what they are offering so that we can focus on areas to create our unique selling points. After some analysis we may discover that the key categories in the water bottle market that influence consumers are:

- Aesthetics

- Colours

- Durability

- Skews

- Customisations

- Branding.

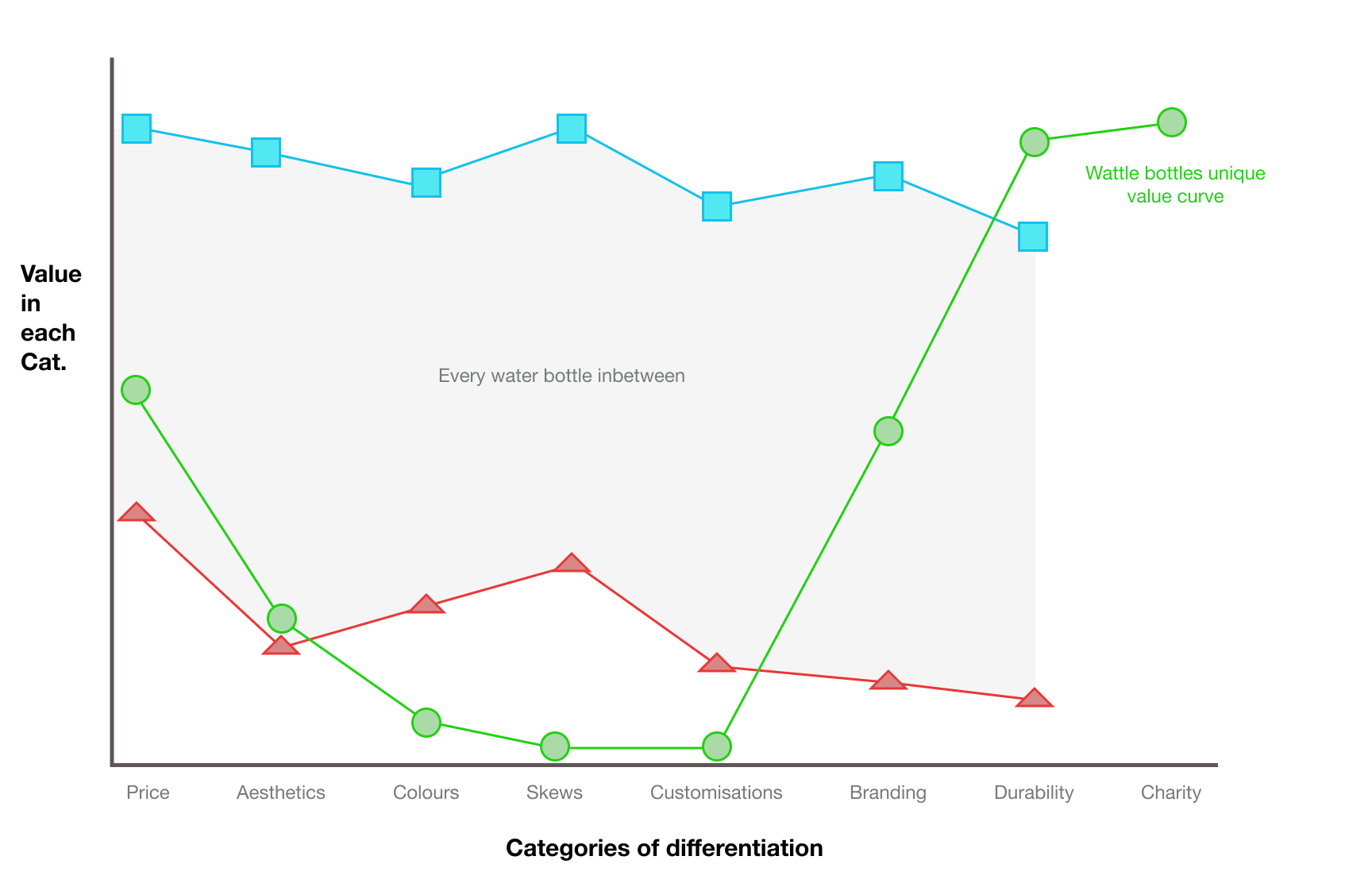

This graph shows how most water bottle companies positon themselves, from the top of the range to the bottom. To keep Wattle competitive, we will try to price our bottles as mid range. To avoid being a jack-of-all-trades but a master of none (in the grey dead zone on the graph), we will try to excel in a few of these categories and dismiss the others.

As an example strategy, we may decide to eliminate skews, colours and customisations completely from our products. Different materials, sizes, colours and customisable elements all add a lot of cost to the manufacturing process. We will however excel in one or two areas to really set ourselves apart from competitors. Wattle decides to excel in the durability of our products. While they may not be the most aesthetic bottles in the world, we can position them as the most durable on the market so that they will be the only bottle our customers will ever need. To further enhance the longevity of our product, we can also add a donation to a charity removing plastic from the ocean, giving our product a new value add that our competitors do not have.

Our value curve now looks like this. We are able to be reasonably priced but still have a product that is divergent from competitors based on our chosen USPs.

Our costs might now look like this:

- Materials for the bottle - $3.50 (reduced by $1.50)**

- Manufacturing one bottle - $2 (reduced by $2.50)***

- Packaging - $1 (reduced by $0.50)***

- Transaction fee/payment processing fee (Stripe or equivalent) - $0.40

- Shipping fee - $2 (reduced by $1)***

- Marketing & ad spend (customer acquisition cost) - $4

- Rainy day reserves - $1 (reduced by $0.50)

- Charity donation to remove plastic from the oceans - $1.10****

** Our material costs for the bottles have been reduced because we will only be making one type of bottle in a single material so we can better avail of the economies of scale. We are, however, now using a high quality and extremely durable material so the cost cannot drop too much.

*** We can make big savings in the manufacturing, packaging and shipping costs per bottle. Because we are only making one type of bottle with no custom features, we can streamline production and eliminate waste material. With only one skew, we can avail of economies of scale in our purchasing of packaging material and the process of packaging, warehousing and shipping our bottles.

**** We have enough room to add a $1.10 donation to charity to further set our product apart and to add customer value.

Still not sure about your price?:

If you are still unsure about what price to charge for your product when you launch then the general advice is to start with a higher price than you think you will need. The logic here is that it’s always easier to let customers know that you are lowering your price than it is to tell them you are going to raise it. If you launch with a high price and still find sufficient traction then great; you’ve just got some excellent market validation and an improved margin.

If you have a product that accepts payments on an on-going basis (like a subscription of SaaS product) and after you launched your product you realised that your pricing was too low, you could adopt a legacy pricing approach. Rather than reaching out to existing customers to raise their prices (and risk losing some of them forever), you can let those early adopters know that their pricing is going to be protected for a certain amount of time or in perpetuity and you can raise prices for all new customers joining. This can actually strengthen your connection with your early adopters and make them champion your product to others.

Key takeaways:

- If you have no idea where to start, begin with unit economics for your costs and add on your desired margin.

- If you are in a price sensitive market, begin with a strategic price and work backwards to hit a target cost. This will require aggressive cuts in certain areas of your product or service.

- It is better to launch with a price that it too high than a price that is too low.